Quicken Simplifi Net Worth: How Much Is the Personal Finance App Worth?

The valuation of Quicken Simplifi as a personal finance app is a complex matter, influenced by its integration within the broader Quicken Inc. portfolio. While it is difficult to assign a definitive net worth to the app, its increasing user base and robust subscription revenue suggest a significant market presence. Furthermore, as it competes with established rivals such as Mint and YNAB, the implications of its growth trajectory and innovative features warrant closer examination. What key factors might determine its future value in the evolving landscape of personal finance management?

Overview of Quicken Simplifi

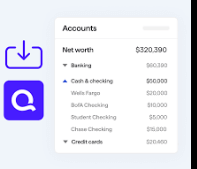

Quicken Simplifi is a personal finance management tool designed to streamline budgeting, expense tracking, and net worth assessment for individuals seeking a comprehensive overview of their financial health.

With a focus on app usability, it allows users to easily navigate their finances, making it simpler to set and achieve financial goals.

This functionality fosters a sense of freedom in financial decision-making.

See also: Puja Dharod Net Worth: How Much Is the Restaurateur Worth?

Key Features of Quicken Simplifi

One of the standout features of Simplifi is its intuitive user interface, which enhances the user experience by allowing for seamless navigation through budgeting tools, expense tracking, and net worth analysis.

The app excels in budget tracking and expense categorization, enabling users to gain a clear understanding of their financial health.

This clarity empowers users to make informed decisions, fostering greater financial freedom.

User Base Growth and Demographics

The user base growth of Quicken Simplifi presents a compelling narrative of increasing adoption among various demographic segments.

Analyzing the trends in user acquisition reveals significant insights into the preferences and behaviors of different age groups and income levels.

Understanding these demographic dynamics is crucial for evaluating the platform’s market positioning and potential for future expansion.

User Growth Trends

How has the user base of Simplifi evolved in recent years, particularly in terms of growth trends and demographic shifts?

Recent data indicates a notable increase in user acquisition, driven by effective engagement strategies.

These strategies have attracted a diverse audience, reflecting the app’s adaptability to varying financial needs.

This growth trend suggests a promising trajectory for Simplifi in the competitive personal finance landscape.

Demographic Insights Analysis

Regularly analyzing demographic insights reveals significant trends in the user base growth of Simplifi, highlighting shifts in age, income levels, and financial behaviors among its diverse audience. This data underscores evolving user behavior and the increasing emphasis on financial literacy, illuminating how different demographics engage with the app to achieve financial freedom.

| Age Group | Income Level | User Behavior |

|---|---|---|

| 18-24 | $20,000 – $40,000 | High engagement with budgeting features |

| 25-34 | $40,000 – $70,000 | Focus on investment tracking |

| 35-54 | $70,000 – $100,000 | Interest in retirement planning |

| 55+ | $50,000+ | Emphasis on expense management |

Revenue Streams of Quicken Simplifi

Quicken Simplifi generates revenue primarily through subscription-based services, providing users with a range of financial management tools and resources designed to enhance their budgeting and tracking capabilities.

By employing various subscription models, the platform effectively fosters consistent revenue growth.

This approach not only ensures a steady income stream but also allows for continued investment in enhancing user experience and expanding service offerings.

Market Comparison With Competitors

In assessing Quicken Simplifi’s position within the financial management software market, it is essential to examine key competitors and their offerings.

This includes a thorough comparison of pricing structures and an analysis of unique features that differentiate each product.

Such insights will provide a clearer understanding of Quicken Simplifi’s competitive advantages and areas for potential improvement.

Key Competitors Overview

The competitive landscape for personal finance management software reveals a range of alternatives to Quicken Simplifi, each offering unique features and pricing structures that cater to diverse user needs.

Competitors like Mint and YNAB provide distinctive competitive advantages, such as budgeting tools and customizable tracking options.

This diversity in the market landscape empowers users to select solutions that align best with their financial goals and preferences.

Pricing Structure Comparison

A thorough comparison of pricing structures reveals significant variations among personal finance management tools, highlighting how different platforms, including Quicken Simplifi, Mint, and YNAB, position themselves to meet the financial needs of their users.

| Platform | Subscription Options | Pricing Tiers |

|---|---|---|

| Quicken Simplifi | Monthly, Annual | $5.99/month, $47.99/year |

| Mint | Free | N/A |

| YNAB | Monthly, Annual | $11.99/month, $84/year |

Unique Features Analysis

Quicken Simplifi consistently distinguishes itself from competitors through its robust integration of budgeting tools, real-time expense tracking, and a user-friendly interface designed to enhance financial management efficiency.

This feature differentiation promotes higher user engagement, allowing users to navigate their financial landscape with ease.

Compared to other personal finance apps, Simplifi’s unique offerings position it as a leader in fostering informed financial decision-making.

Financial Performance Metrics

Financial performance metrics serve as essential indicators of an organization’s economic health, providing insights into profitability, efficiency, and overall financial stability.

Key performance indicators, such as revenue growth, profit margins, and return on investment, enable stakeholders to assess the effectiveness of financial strategies.

Utilizing these financial metrics fosters informed decision-making, ultimately empowering users to enhance their financial well-being and pursue greater economic freedom.

Customer Reviews and Feedback

Numerous customer reviews and feedback highlight the strengths and weaknesses of Quicken Simplifi, offering valuable insights into user experiences and satisfaction levels with the platform’s features and functionalities.

Users appreciate its intuitive interface and budgeting capabilities, reflected in positive satisfaction ratings.

However, some criticisms arise regarding syncing issues and limited investment tracking, suggesting areas for improvement to enhance overall user satisfaction.

Future Projections and Developments

The future of Simplifi by Quicken appears poised for growth and enhancement, driven by user feedback and evolving market demands that highlight the need for improved functionality and user experience. Future trends indicate a focus on integration with emerging financial technologies, while development opportunities lie in personalization and automation features.

| Future Trends | Development Opportunities |

|---|---|

| Increased mobile integration | Enhanced budgeting tools |

| AI-driven financial insights | Customizable user interfaces |

| Cross-platform compatibility | Advanced reporting features |

| Real-time transaction alerts | Expanded investment tracking |

| Improved security measures | Collaborative financial planning |

Impact on Personal Finance Management

As Simplifi by Quicken continues to evolve in response to user needs and technological advancements, its impact on personal finance management becomes increasingly significant, offering tools that enhance budgeting, tracking, and strategic financial decision-making.

The app fosters improved financial habits by providing users with effective budgeting strategies, enabling them to allocate resources wisely and ultimately achieve greater financial independence and control over their financial futures.

See also: Pravin Dugel Net Worth: A Look at the Ophthalmologist’s Wealth

Conclusion

In summary, Quicken Simplifi demonstrates significant potential within the personal finance sector.

Its growing user base, diverse revenue streams, and innovative features position it favorably against competitors.

Financial performance metrics indicate robust health, while customer feedback highlights user satisfaction.

As the app continues to evolve, akin to a compass guiding users toward financial stability, it is poised for sustained growth and impact on personal finance management, reinforcing its value within Quicken Inc.’s broader portfolio.